no-fault insurance driver's license deductibles insurance group deductibles

no-fault insurance driver's license deductibles insurance group deductibles

You might not legally drive the lorry as of the suspension date provided in the letter. The "neglect" letter implies your insurance coverage company has actually reacted to the confirmation card sent out to you by validating your insurance details.

sr22 sr-22 sr22 coverage sr22 vehicle insurance

sr22 sr-22 sr22 coverage sr22 vehicle insurance

In most cases this suggests your insurer confirmed insurance coverage with the DMV, and absolutely nothing even more is required. You might legitimately drive the car if the registration is otherwise legitimate. Use the Insurance Coverage and Registration Status Inquiry to ensure. What is an SR22? How does this associate with an insurance reinstatement? "SR-22 Insurance coverage" is a Certificate of Financial Duty that your insurer will file with the DMV.

motor vehicle safety driver's license no-fault insurance motor vehicle safety division of motor vehicles

motor vehicle safety driver's license no-fault insurance motor vehicle safety division of motor vehicles

The penalty for the gap of insurance might still use. I will be car parking my car as well as might acquire "garage" insurance coverage. Garage insurance coverage is NOT obligation insurance coverage, and also as a result is not appropriate or reported to the DMV. auto insurance.

If you drop the liability insurance for any type of factor, you must terminate the enrollment and surrender the license plates. NVLIVE verification uses just to responsibility insurance. See Permit Plate Surrender. Please consult your insurance coverage agent to verify whether you have responsibility coverage. I'm having a conflict with my insurance company/agent.

Not known Factual Statements About For How Long Do You Need Sr22 Insurance In Ohio?

If 5 years pass from the date of suspension prior to you reinstate your opportunities, after that the SR-22 would certainly not be needed. If the SR-22 is cancelled prior to the needed time and a brand-new form not submitted, your driving privileges will be put on hold - car insurance.

division of motor vehicles department of motor vehicles sr-22 sr22 coverage dui

division of motor vehicles department of motor vehicles sr-22 sr22 coverage dui

If you have actually been requested for an SR-22, you may be questioning what that term means. There are times you'll require an SR-22 to renew your vehicle driver's certificate, as well as although the procedure isn't made complex, it takes a while to complete - vehicle insurance. This overview will assist you discover everything you require to learn about what SR-22 insurance is for, who needs it and just how to get it.

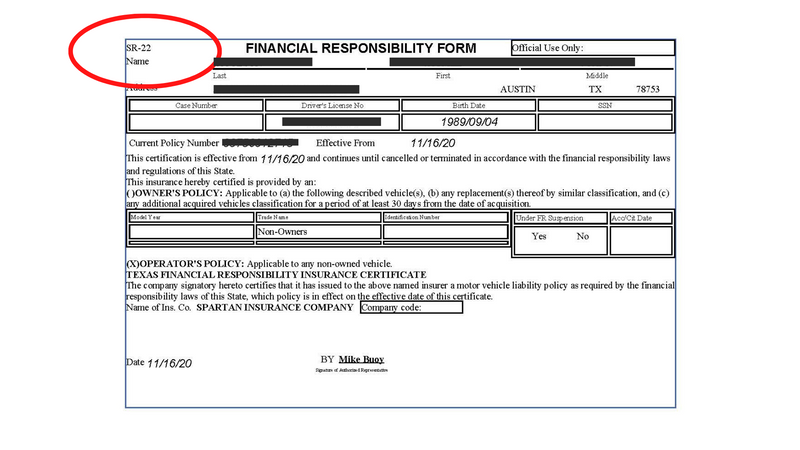

An SR-22 is also understood as a statement of monetary obligation and shows that you have actually paid for the state's minimum responsibility vehicle insurance coverage as called for by regulation. The SR-22 is connected to your existing automobile insurance coverage. If you do not have insurance coverage, you'll require to get guaranteed first before you can ask for an SR-22 declaring.

You triggered a crash as well as were captured driving without cars and truck insurance coverage. You were founded guilty of a DUI or DWI. You have several website traffic offenses over a set duration of time such as 6 months. You are behind on the youngster assistance gotten by the courts. If any of these declarations use to your circumstance, you may need an SR-22.

A Biased View of Sr-22 Insurance: What It Is And How To Get It – Forbes Advisor

If you don't have cars and truck insurance coverage, you'll need to acquire an auto insurance coverage initially. It's most likely you'll be needed to pay for a six month or yearly plan in advance. If your license was put on hold for a DUI or various other severe infraction, the expense of auto insurance will likely be high.

If not, you might need to locate an additional insurer. Once you have a plan (or if you already have insurance coverage), getting an SR-22 kind is easy. Get in touch with your vehicle insurance business to ask for an SR-22 and also they'll deal with the documents for you - deductibles. Do you require an SR-22 kind to get vehicle insurance policy? Vehicle insurance coverage is the prerequisite to obtaining an SR-22 form, not the various other way around.

How a lot does SR-22 insurance expense? Individuals commonly ask how much does SR-22 insurance policy cost a month. The quantity your vehicle insurance policy increases depends on the insurance company.

Financial Responsibility Filing (Sr22) Information - Wisconsin ... for Beginners

The need to have one can last upwards of 3 years depending on the violation extent causing you to require one. Exactly how do I eliminate an SR-22? When the DMV no much longer requires you to have an SR-22, you'll require to ask your vehicle insurer to eliminate the SR-22 - auto insurance.

sr22 car insurance driver's license credit score liability insurance

sr22 car insurance driver's license credit score liability insurance

Some, but not all, states require you to obtain an SR-22 if your vehicle driver's license has been withdrawed or put on hold and you desire to drive again. You may require to have an SR-22 on file for one to five years, depending upon the state. What Is SR-22 'Insurance policy'? An SR-22 is a file that shows evidence of economic obligation in instance you're included in an auto mishap.

Who Needs an SR-22 Certificate? The rules for when an SR-22 is needed vary by state, and not all states require motorists to have one. In Texas, as an example, vehicle drivers are needed to submit an SR-22 with the state division of insurance if their certificate was put on hold due to an auto accident, they've gotten a 2nd or succeeding conviction for not having responsibility insurance coverage, or a civil judgment has been submitted versus them.

Once again, not everyone requires an SR-22. Normally, you may be needed to have one if you: Are caught driving without a certificate or insurance policy, Have a driving under the influence (DUI) or driving while intoxicated (DWI) sentence, Have a permit suspended due to too much crashes or relocating infractions, Owe superior court-ordered child assistance repayments, Sustain several repeat driving offenses in a short time frame, Are applying for a hardship or probationary driving authorization Maintain in mind that you might be Homepage required to have an SR-22 on data in the state you're licensed in also if you live and drive in another state.

Sr22 Insurance: What Is It And Do I Need It? - Coverage.com for Beginners

Some states need insurance policy business to alert them when an SR-22 gaps or is terminated. The length of time you need to preserve an SR-22 certification will certainly additionally depend on your state's demands - sr-22 insurance.

If you're purchasing a new car insurance policy, you may have the ability to save money by looking around. Tell the insurance provider upfront that you need an SR-22, simply to ensure the firm supplies them. When you have an SR-22 certificate, the insurance business will certainly submit it with the state on your part.

Call 225-964-6720 Having an SR22 permit could be challenging and even a mystical procedure for numerous. With our experienced attorneys at Carl Barkemeyer, we will be able to direct you via the process of getting an SR22 certificate - underinsured. The SR-22 license is an additional insurance policy certification to an insurance plan, and also not the insurance coverage itself.

Usually, this certification is offered by the insurance provider, under the supervision of the Department of Motor Vehicles to vehicle drivers that are thought about as a risk to the general public or in web traffic, possibly as a result of a DUI conviction or a document of driving under the impact of alcohol or Any kind of various other mind-altering substance.

What Is Sr-22 Insurance And How Much Does It Cost? Fundamentals Explained

By the laws of Louisiana, it is vital for a vehicle driver whose certificate has actually been put on hold, to look for an SR-22 Permit. no-fault insurance. As long as you appear to be a danger to other roadway customers you have to reveal your economic obligation to pay for the minimum cars and truck insurance coverage. The state of Louisiana will after that mandate you to complete the form Department of Motor Autos, your license will be put on hold and also the SR22 permit released.

The issue that lots of drunk driving convicts encounter is recognizing the length of time they would certainly maintain the SR22 permit. The size of time actually varies, depending upon the severity of the sentence, and really significantly, the attorney one has worked with to manage his situation. If you're in Louisiana, do not hesitate to Baton Rouge, a drunk driving lawyer with a number of years of experience in the field (sr-22).

The quantity of time a person is required to lug the SR22 Licence differs across the numerous States in the United States. The default time period in Louisiana, as it is with lots of States is 3 years (credit score). Throughout these 3 years of lugging the SR22 Licence, you will have to preserve continuous protection of the SR22 insurance plan.

The amount of time which an individual would lug the SR22 permit is usually specified by the Division of Electric Motor Autos. The standard time for lugging an SR22 license is 3 years, several various other elements could make the duration of carriage much shorter or longer. Prior to we enter into this, let us first take into consideration the list below factors bring about an SR22. sr-22.

Getting The How Long Do I Have To Carry An Sr-22 License After Dwi In ... To Work

If the violation is being committed by the culprit for the very first time, the court may give a 6-month sentence to the culprit. This will imply that the transgressor's motorist's license as well as enrollment will certainly be put on hold for those 6 months as part of the penalty. During this period, he will certainly be expected to obtain an SR22 type from the insurance policy business to reveal that he is monetarily accountable to birth the minimum requirements of cars and truck insurance coverage in his state - deductibles.

The DUI convict will normally hold his SR22 permit for as long as the drunk driving program last. It is till the drunk driving program has actually been successfully wrapped up that the SR22 certificate be revoked and also the motorist's license restored. The size of the DUI program differs from one person to another, conditions, and also seriousness of the infraction.

If a Drunk driving found guilty or transgressor either rejects to go through the proposed chemical test, has his BAC degrees over 0. 15% or has repetitively violated the legislation on drunk driving, such a person will need to participate in 9 months of DUI treatment program or even more, in enhancement to whatever conviction or sanction already netted out.

The DUI therapy program can be as long as 10 months if the court orders it to be so. The court might make such an order if the transgressor's BAC degree is over 0. 20%. This is the phase where the culprit is called for to set up an Ignition Interlock Device in his car.

See This Report about Missouri Sr-22 Insurance Faqs

If the offender refuses to take the chemical test at the time of apprehension, or has gone against the DUI legislation more than 2 times already, also if BAC degree is simply over 0. ignition interlock. 15%, he would certainly need to undertake 1 year of DUI therapy, as well as a suspension of his licence for the same amount of time.

Any Colorado citizen who has actually had their driver's permit withdrawed for driving intoxicated is called for by the Department of Earnings, Department of Motor Autos (DMV) to obtain "Evidence of Insurance policy" prior to reinstatement of their driving advantages. This kind of insurance coverage, recognized as an SR-22, calls for the insurance policy carrier to report any type of lapse in insurance policy protection to the Colorado Motor Vehicle Division.

The insurer ensures the DMV it will certainly give notification to the DMV of termination in the occasion of costs non-payment. How do I know if I require SR-22? SR-22s are needed for certificate suspensions or cancellations. Drunk drivings, Driving without insurance, Repeat traffic offenses, etc. Please contact your neighborhood DMV to find out if you require an SR-22 certificate.